Stamp Duty For First Time Buyers 2024. What qualifying conditions must be met? The threshold at which the tax falls due has been raised to £250,000 from its current £125,000 level.

Login or subscribe to read more. First time buyers in england and northern ireland do not pay stamp duty on properties that costs up to £425,000 and pay 5% on the portion from.

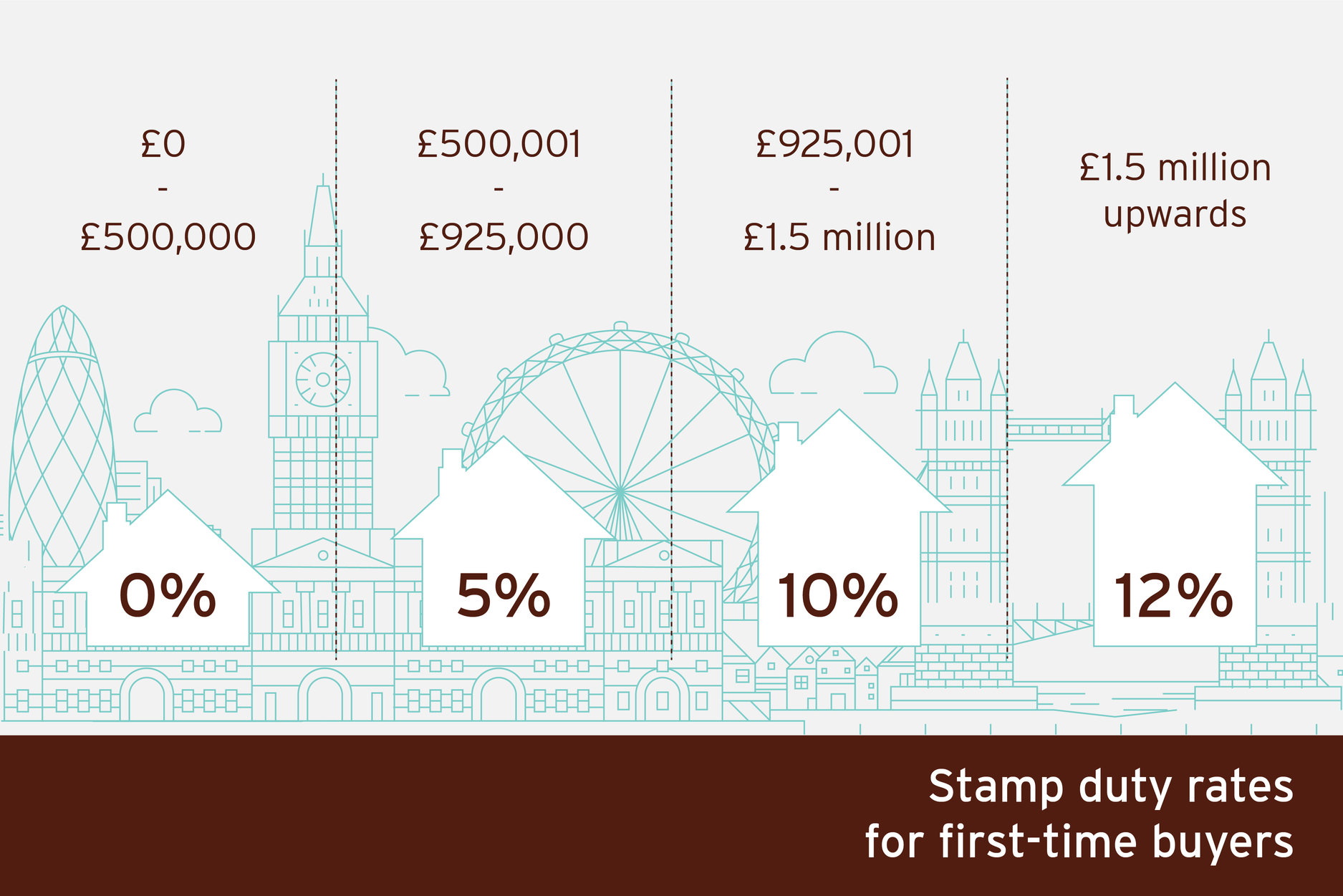

Stamp Duty Is Levied As A Percentage Of The Property Price, So The Higher The Value Of The Property You Buy, The Higher Rate Of Stamp Duty You Will Have To Pay.

What qualifying conditions must be met?

They Pay No Sdlt On The.

Stamp duty land tax manual.

On Any Property Purchase Price Of Up To.

Images References :

Source: blog.roshi.sg

Source: blog.roshi.sg

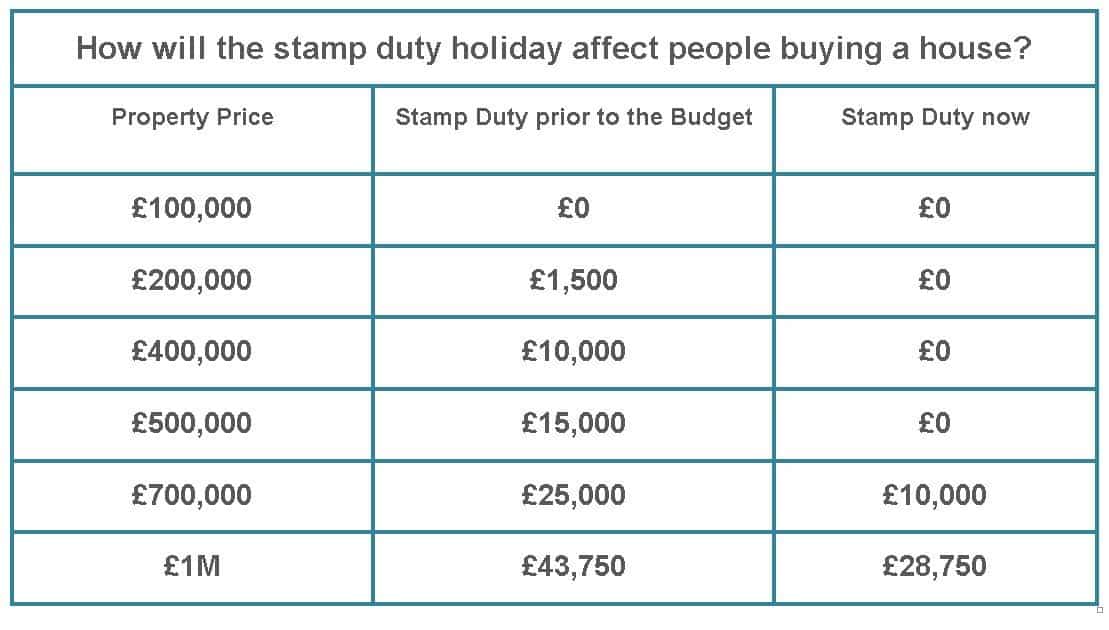

Buyers Stamp Duty Singapore 2023 ᐈ Calculate BSD/ABSD Tax, They pay no sdlt on the. The measure will benefit first time buyers of residential properties where the purchase price does not exceed £500,000 saving purchasers up to £5000.

Source: osbornlaw.com.au

Source: osbornlaw.com.au

Stamp Duty Threshold for First Home Buyers Reduced Osborn Law, The stamp duty relief rates for first time buyers are: If you're buying a home that costs £625,000 or less, you'll pay 0% up to £425,000 then 5%.

Stamp duty 4.3m homes pushed into higher bracket, 5% duty on the amount over £300,000. How much stamp duty do first time buyers pay?

Source: griffinproperty.co

Source: griffinproperty.co

Stamp Duty for FirstTime Buyers A Guide and Explanation, Stamp duty for first time buyers. The threshold at which the tax falls due has been raised to £250,000 from its current £125,000 level.

Source: makanwalay.com

Source: makanwalay.com

First Time Buyer Stamp Duty What You Need to Know Makanwalay, Stamp duty is levied as a percentage of the property price, so the higher the value of the property you buy, the higher rate of stamp duty you will have to pay. They pay no sdlt on the.

Source: www.hotzxgirl.com

Source: www.hotzxgirl.com

Stamp Duty Table Hot Sex Picture, Stamp duty land tax manual. 5% duty on the amount over £300,000.

Source: www.marshandparsons.co.uk

Source: www.marshandparsons.co.uk

Stamp Duty Buying Advice for London Properties Marsh & Parsons, The price at which stamp duty is paid was doubled from £125,000 to £250,000. First time buyers in england and northern ireland do not pay stamp duty on properties that costs up to £425,000 and pay 5% on the portion from.

Source: abetterplumber.org

Source: abetterplumber.org

Stamp duty on second homes Quick reference guide A Better Plumber, The stamp duty relief rates for first time buyers are: The threshold at which the tax falls due has been raised to £250,000 from its current £125,000 level.

Source: beaumontgibbs.lifesycle.co.uk

Source: beaumontgibbs.lifesycle.co.uk

Stamp Duty Cut to Save First Time Buyers up to £8,750, The threshold at which the tax falls due has been raised to £250,000 from its current £125,000 level. The price at which stamp duty is paid was doubled from £125,000 to £250,000.

Source: www.homeviews.com

Source: www.homeviews.com

Do first time buyers pay stamp duty? HomeViews, 5% duty on the amount over £300,000. The measure will benefit first time buyers of residential properties where the purchase price does not exceed £500,000 saving purchasers up to £5000.

First Time Buyers In England And Northern Ireland Do Not Pay Stamp Duty On Properties That Costs Up To £425,000 And Pay 5% On The Portion From.

What qualifying conditions must be met?

How Much Stamp Duty Do First Time Buyers Pay?

The stamp duty relief rates for first time buyers are: